There’s a new generation of online shoppers in town — and flexible payment options are their calling cards. At the top of the stack are “buy now, pay later” (BNPL) payment options, which have managed to capture the attention (and wallets) of buyers across the country since the beginning of the pandemic.

As the name implies, BNPL enables customers to purchase products without paying for them in their entirety at the time of the transaction. Instead, the customer only pays a portion of the total price during checkout, and the remainder of the cost is spread out equally across several installments over a designated period.

This type of point-of-sale (POS) installment loan typically features a quick and easy approval process. BNPL often charges zero interest, making it one of the most attractive payment options out there. According to PYMNTS, BNPL nearly doubled in growth during the 2021 holiday season regarding shoppers’ preferred online payment methods.

PYMNTS research also found that BNPL is most sought after by two key demographics entering their peak spending and earning years: millennials and bridge millennials. Each group showed a 30% preference for BNPL, whereas only 22% of all age groups and 13% of baby boomers and seniors expressed the same interest.

As more online retailers introduce BNPL options to satisfy customer demands, it’s essential to consider how this payment option can help keep you competitive and boost sales. Let’s walk through how BNPL works for ecommerce businesses, a few real-world examples of BNPL in action, and why online shoppers love it. We’ll also break down key advantages, disadvantages, and some of the most popular BNPL apps out there.

How Does Buy Now, Pay Later Work?

Online shopping with buy now, pay later works seamlessly during the customers’ online checkout process. Once a customer is instructed to enter a form of payment for their purchase, they’ll be given a BNPL option that enables them to put down a smaller initial deposit and break up the rest of the cost over a fixed period.

When choosing a BNPL option, a customer will be directed to fill out a brief application, typically without leaving the checkout page. This application commonly requires the customer to provide their general information (e.g., full name, address, birth date, phone number, and email address) and a preferred payment method, such as a credit card or debit card.

Some BNPL providers instantly conduct soft background checks on customers and approve or deny their applications on the spot. Each provider maintains its criteria for BNPL loan approval, but even customers that have a bad credit score or no score at all could still be eligible.

Once a customer is approved, the BNPL provider will dictate how much is due during the initial transaction, how the rest of the payments will be split up over a fixed period, and whether interest will accrue on the loan. Many providers break charges into equal parts, with each payment due every two weeks.

For ecommerce businesses, the BNPL loan provider typically handles the financial risk, while the business owner is paid for the total amount of the product upfront. However, business owners generally are required to pay transaction fees to a BNPL provider for each BNPL-related sale.

3 Buy Now, Pay Later Online Stores

Online retailers, small and large, are jumping into the world of BNPL. Here are some of the most prominent buy now, pay later online store examples out there:

1. Adidas

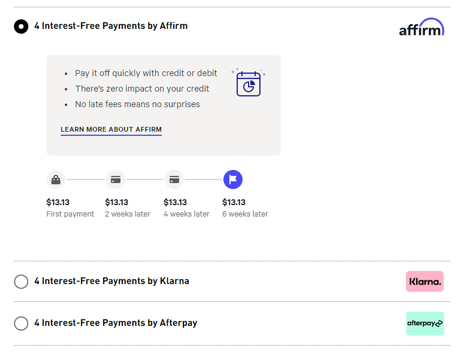

Adidas partners with several different BNPL providers to offer their customers options for installment loans. When prompted to enter a payment method, customers can choose BNPL options like Affirm, Klarna, and Afterpay. Check out this example of the Affirm BNPL option on the Adidas website, which offers four interest-free payments and an approval process that doesn’t impact a customer’s credit score.

2. Purple

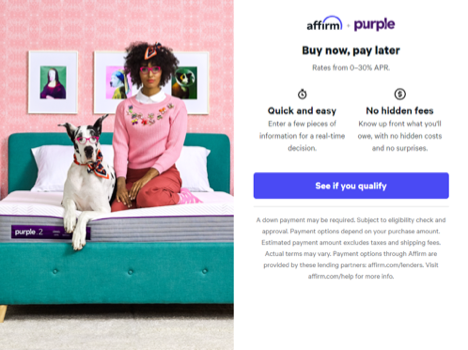

Purple, creators of the GelFlex Grid purple mattress, also offer BNPL options when customers purchase through their website. When a customer lands on the site’s checkout page, they have the option to choose the BNPL provider Affirm. Here’s a quick breakdown of the Affirm and Purple BNPL partnership.

3. Target

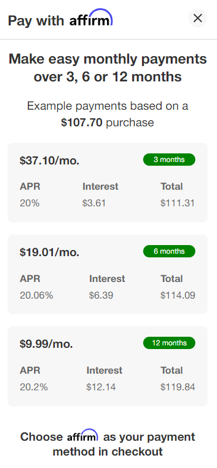

Target is one of the many big-box department stores that offer BNPL as an option during the online checkout process. However, Target requires customers to purchase $100 or more to be eligible for the Affirm, their primary BNPL partner. Here is an example of Affirm BNPL payment options with Target for an item that’s priced at just over $100.

Why Customers Love Buy Now, Pay Later

Buy now, pay later is not a new concept. Similar payment installment plans were introduced to the average person as early as the 19th century (between 1840 and 1890) for furniture, pianos, farming equipment, and sewing machines.

One of the most prominent organizations to offer payment installment plans was Singer Sewing Machines, which started the “dollar down, dollar a week” selling tactic in the late 1880s and early 1890s. Not surprisingly, the company tripled its sales in just one year due to this strategy.

But if payment installment plans are over a century old, why are they just now gaining popularity again? Several factors are contributing to the current rise in BNPL. Most notably, the explosion of ecommerce solutions and the convenience it provides for shoppers has created the perfect environment to introduce even more convenient payment methods to attract consumers.

Many shoppers are also steering clear of racking up balances on credit cards that charge high-interest rates and fees, which means they are looking for other ways to finance their purchases. According to the Consumer Financial Protection Bureau (CFPB), average credit card balances were roughly 8% lower in April 2021 compared to April 2020 — and balances in April 2020 were already substantially lower than they were in April 2019.

Because BNPL purchases are typically geared towards smaller-ticket items, many shoppers can avoid accruing interest or fees like they would with other types of credit or loans. What’s more, BNPL can lower purchase apprehensions for many.

Between instant credit approvals, soft credit checks, no interest or fees (as long as payments are made on time), and flexible payment schedules, cost-conscious shoppers gain a sense of control with BNPL. Plus, it enables them to get “must-haves” or exclusive items quickly without having to fork over the total cost upfront.

Sell your products online, worry-free

Officially recommended by WooCommerce, our hosting is made for online businesses like yours

Benefits of Buy Now, Pay Later Plans

As an ecommerce business owner, offering buy now, pay later plans to your customers can provide you with a wide range of benefits.

Maintain your competitive edge: More ecommerce businesses are introducing BNPL options for their customers. To stay competitive in your market or niche and meet customer demands, it’s also essential to offer BNPL. Not only will this help you even the playing field, but it will give you an advantage over competitors that have yet to provide BNPL plans.

Boost sales: According to a study by PYMNTs that surveyed 360 businesses that generated $10 million or less in revenue, 33% stated that offering BNPL increased their revenues from 2019 to 2020. Not only are customers responding positively to ecommerce businesses providing multiple payment options, but they are more likely to move forward with a purchase if they feel confident in their ability to pay for it — and BNPL makes this a reality.

Slash shopping cart abandonment rates: Just like BNPL plans can boost sales, they can also slash shopping cart abandonment rates. According to a study conducted by Mastercard using their transaction data, the Mastercard Installments BNPL program reduced shopping cart abandonment by 35% after it was implemented. Most shoppers abandon their carts because extra costs are too high, and BNPL plans help spread out these upfront costs.

Increase customer loyalty: As an ecommerce business, it’s essential to do everything you can to keep your customers happy and increase their loyalty. By offering multiple payment options — including BNPL programs — you’re showing your customers that you value them and their needs. And the more valued your customers feel, the more loyal they will be — which means higher customer lifetime values (CLV).

Drawbacks of BNPL Plans

BNPL plans can offer serious advantages for both online shoppers and ecommerce business owners, but that doesn’t mean they come without any disadvantages.

Increased transaction fees: BNPL providers can charge merchants anywhere from 2% to 8% of the product purchase value (including taxes) for each BNPL-related transaction. On the other hand, the fees associated with standard debit or credit card transactions can reach 2.9%.

Installment loan caps for customers: BNPL providers can implement a cutoff for the number of BNPL loans a customer can have. This means that it could be difficult for ecommerce business owners to maintain repeat-customer relationships with those who are only interested in purchasing products using BNPL. What’s more, once BNPL is introduced, it could break consumer trust if it’s removed from your ecommerce site.

BNPL replacing other payment options: When customers reach for interest-free BNPL payments, they are avoiding other available payment options that could cost significantly less for online business owners to use (e.g., debit or credit card transactions that typically charge lower fees). This means an online business could lose money in the long run from absorbing higher transaction fees from BNPL providers.

Complicated return processes: Because a third-party BNPL provider handles BNPL-related transactions, your ecommerce shipping strategy can get complicated when it comes to returns. For example, some providers could hold your customers responsible for the total purchase cost after an item has been returned, which could lead to broken consumer trust and loyalty.

Is Buy Now, Pay Later Right For Your Business?

There are a few key factors to consider when determining whether BNPL is right for your ecommerce business.

For example, BNPL is typically a suitable payment option to offer your customers if you operate in a high-margin vertical, such as fashion, consumer electronics, cosmetics, or other retail businesses. This is because any transaction fees you incur from BNPL providers can more easily be rolled into the actual costs of your products.

However, if your business has lower profit margins, it’s wise to consider if the transaction fees you’ll pay to offer BNPL for your customers are worth it.

Other questions to consider when deciding if BNPL is right for you include:

How easy is it to integrate your preferred BNPL program into your current checkout process?

What payment plans does your preferred BNPL provider offer customers, and how does each affect the transaction fees you’ll pay?

Does your preferred BNPL provider take full responsibility for financial risk and fraud for each transaction?

Popular BNPL Apps: A Breakdown

You can consider several BNPL providers that can help you seamlessly integrate BNPL options into your ecommerce store’s checkout process. Below, we’ve detailed some of the apps on the market today based on annual percentage rates (APR), loan periods, loan amounts, and late fees.

| Buy Now, Pay Later Apps | APR | Loan Periods | Loan Amounts | Late Fees |

| Affirm | 0% to 30% | 1 to 48 months | Up to $17,500 | $0 |

| Sezzle | 0% | 6 weeks (8 weeks including free one-time payment reschedule) | Based on financial eligibility | $10 |

| Afterpay | 0% | 6 weeks | Starts at $500 and increases based on financial eligibility | Up to 25% of the transaction amount |

| Splitit | 0% | 3 to 24 months | Uses existing credit card limits | $0 |

| Perpay | 0% | 4, 8, 16, or 18 payments | $500 to $2,000 | $0 |

| PayPal Pay in 4 | 0% | 6 weeks | $30 to $1,500 | $0 |

| Klarna Pay in 4 | 0% | 4 weeks | Based on financial eligibility | $7 |

| Zip | 0% | 6 weeks | $35 to $1,500 (Maximum dependent on merchant) | $5, $7, or $10 based on state of residence |

Launch Your Ecommerce Site and Get Started with BNPL

Buy now, pay later plans are increasing in popularity, especially with younger generations entering their prime earning and spending years. As an ecommerce business owner, offering BNPL options to your customers enables you to accommodate their needs while giving you a competitive edge.

Including these POS installment loans in your online checkout process can also help you boost sales and average order value (AOV), reduce shopping cart abandonment rates, and build customer loyalty with a new generation of online shoppers.

If you’re still in the planning phase of your ecommerce business, you need a well-designed website that can streamline online sales and seamlessly incorporate BNPL options for your customers.

With managed hosting by Nexcess, you gain access to a lightning fast CDN, intelligent analytics, and Plugin Performance and Sales Performance monitoring tools so you're always in the know about your site and sales.

Our powerful ecommerce engine provides things like premium WooCommerce plugins, next-gen themes, and automated site maintenance right out of the box.

Check it out to get started today.